Compliance That Prevents Costly Mistakes

Reduce regulatory risk, avoid penalties, and control compliance costs as your business scales.

The Real Cost of Non-Compliance

Mid-size companies are increasingly exposed to:

Regulatory Cost Exposure

Expanding regulatory obligations increase compliance costs and the risk of administrative fines.

Audit-Driven Financial Penalties

Failed audits and unmet compliance requirements result in contractual penalties and unplanned expenditures.

Revenue Impact from Compliance Delays

Compliance gaps lead to delayed, renegotiated, or lost enterprise contracts and renewals.

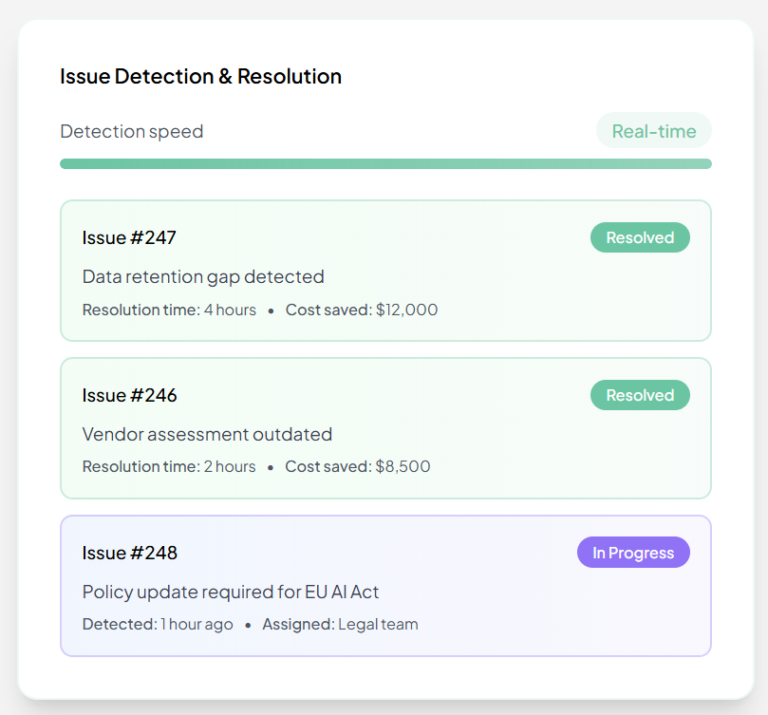

High Cost of Reactive Remediation

Addressing compliance issues late significantly increases remediation, consulting, and operational costs.

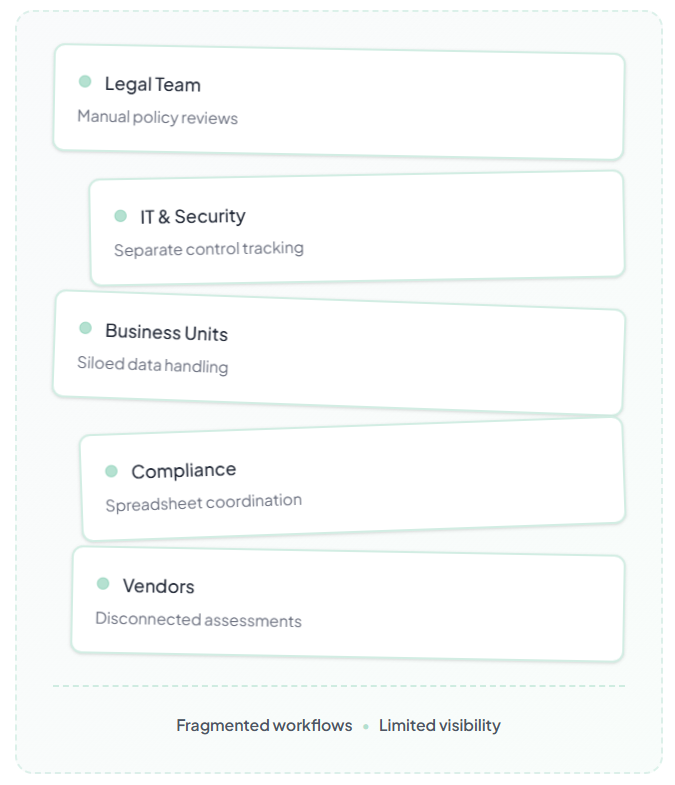

Where Traditional Compliance Breaks Down

Compliance responsibilities are often fragmented across legal, IT, security, and business teams.

- Typical challanges include:

- Documentation - scattered across teams and tools

- Limited visibility - into compliance gaps

- Reactive audits - driven by incidents or client pressure

- Great costs - Heavy reliance on external advisors

- Rising compliance spend - with limited risk reduction

- The result: higher spend, higher risk, and limited control.

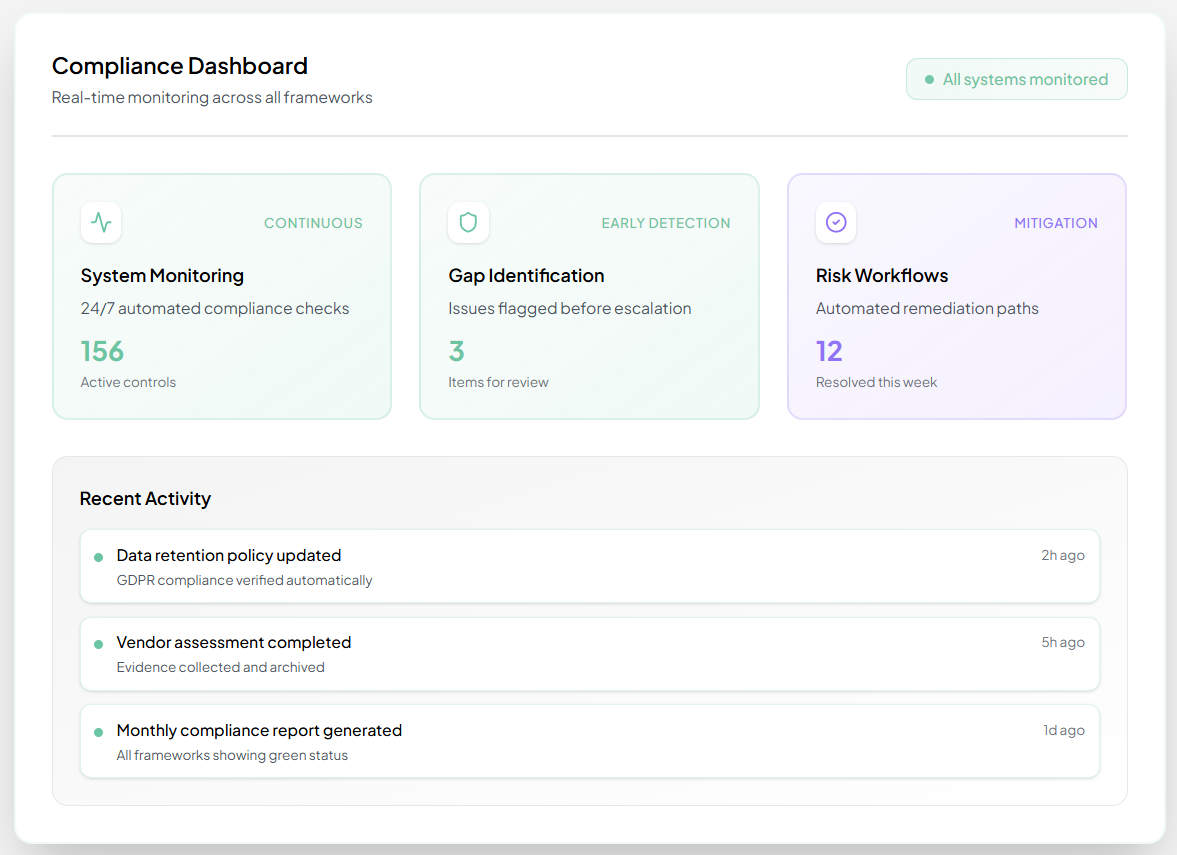

Whisperly: Proactive Compliance Risk Management

Whisperly helps mid-size companies proactively manage compliance, reducing the risk of fines and penalties.

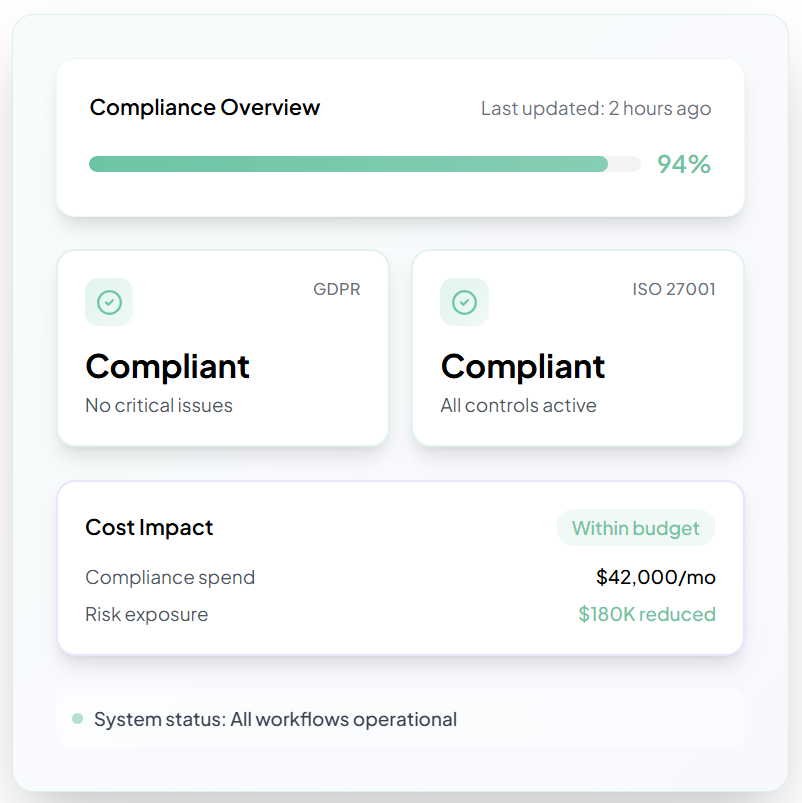

Predictable Compliance Costs, Reduced Legal Effort

Whisperly helps mid-size companies address compliance gaps early, lowering the need for emergency legal work, external counsel, and costly remediation.

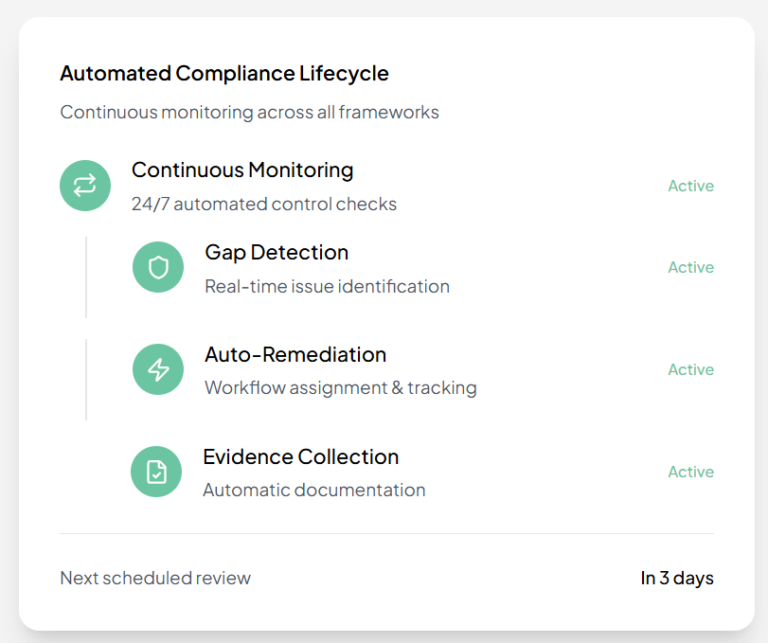

Continuous Regulatory Readiness With Less Manual Work

Compliance across key regulatory frameworks runs as an ongoing, structured process, reducing ad-hoc projects, repetitive documentation, and internal resource drain.

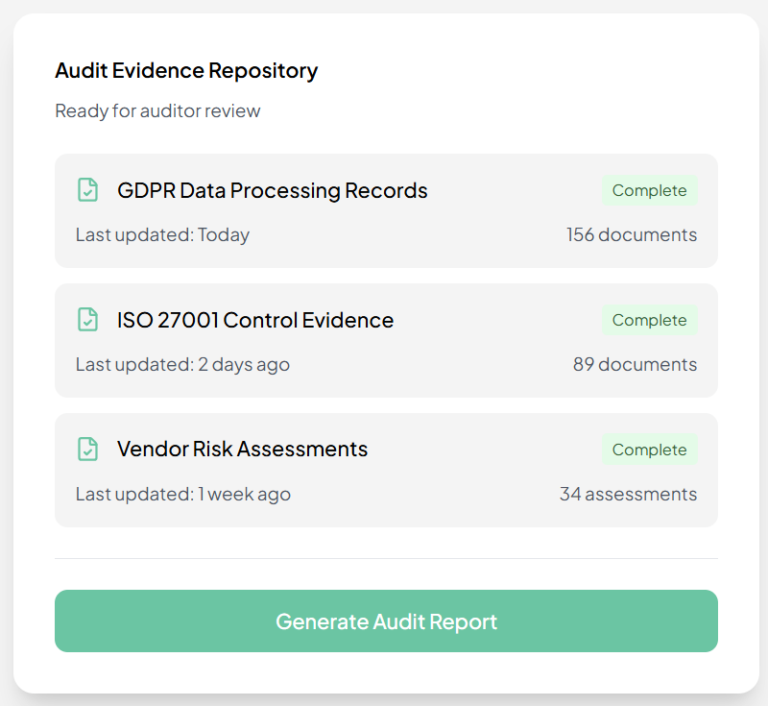

Faster Audits with Minimal Internal Disruption

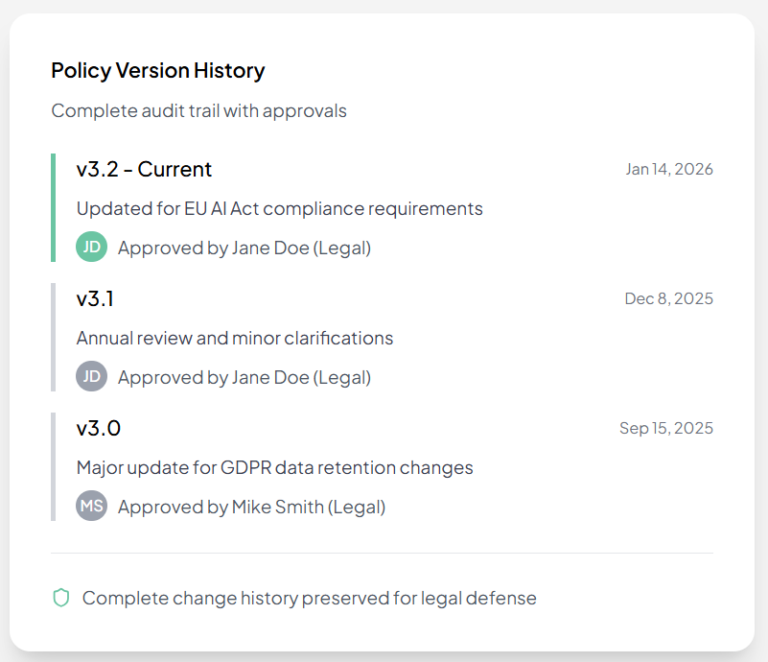

Whisperly keeps documentation, controls, and evidence continuously up to date, cutting preparation time, internal coordination, and audit-related expense.

Stronger Legal Defensibility

Clear, auditable compliance evidence supports regulatory interactions, enforcement inquiries, and contract negotiations, reducing legal risk and compliance-related costs.

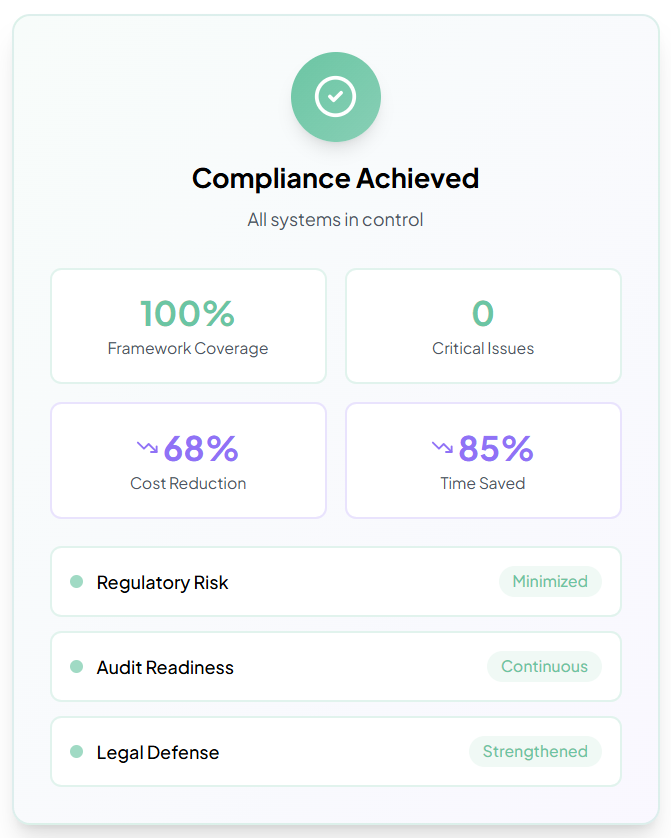

The result

Regulatory compliance achieved with lower internal effort, reduced costs, and minimized exposure to fines and penalties.

- Predictable compliance operating costs

- Continuous regulatory readiness without manual overhead

- Reduced risk of penalties and legal exposure

- Faster audits with minimal business disruption

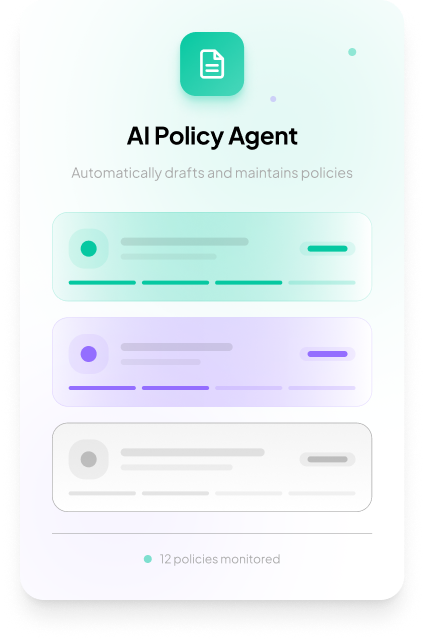

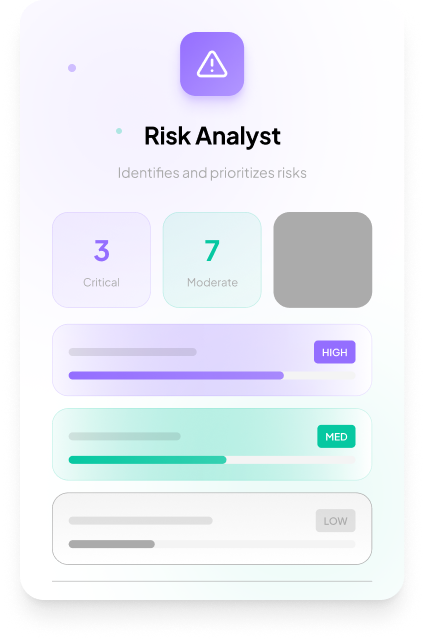

Autonomous Agents that work for you

We take a different approach to compliance: AI works, people monitor